Announcement of Bankruptcy Filing Foreshadows What's to Come

The sudden fall of the oil market is already wreaking havoc on companies, and recent bankruptcy filings may be just the beginning.

On March 31, Covington, La.,-based Hornbeck Offshore Services, Inc., a leading provider of marine transportation services to exploration and production companies, announced in its Form 8-K SEC filing that “the Company is in the process of negotiating and finalizing a restructuring support agreement with the forbearing creditors on the terms of a consensual balance sheet restructuring during this forbearance period, to be implemented through a prepackaged chapter 11 filing in the Southern District of Texas.” Hornbeck avoided the wave of bankruptcy filings that occurred in the oil and gas industry after the price drop in 2015. However, the recent price war between Russia and Saudi Arabia followed by the COVID-19 pandemic has pushed the company to the brink, and all indications are that there will be a similar ripple effect across the industry. Hornbeck’s announcement is an indicator of what’s to come, and states like Louisiana, Texas, New Mexico, and North Dakota that rely on a strong oil and gas industry are expected to be hard hit.

The delicate balance between oil prices and energy sector profitability is the concern, and analysts think the industry has reached the tipping point at which some companies simply won’t survive. “A lot of people argue we’re at that moment now,” said Gifford Briggs, president of the Louisiana Oil and Gas Association. “I think this is it or we are at least crossing into it when you go south of $30 or $35 a barrel. These are areas that are pretty precarious because when it comes to the business plans and forecasts, those prices aren’t just off, they’re way off.”

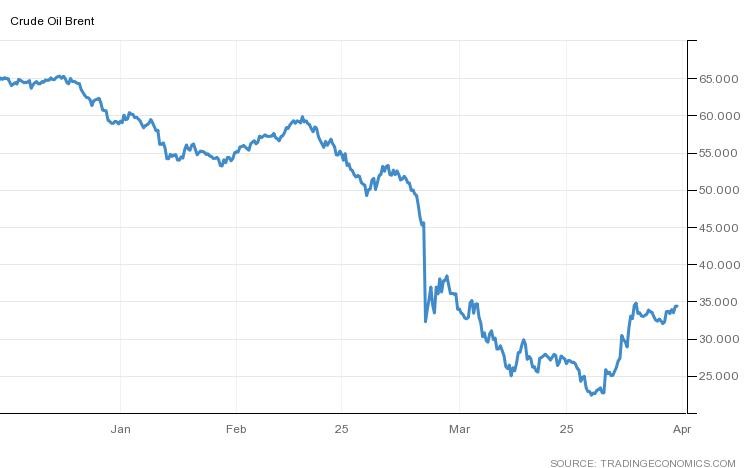

Following these comments, oil prices reached a 17-year low on March 18 when Brent was priced at $24.72 a barrel and WTI at $20.48 a barrel. On March 30, Brent reached a price of $22.38 a barrel. The decline amounted to an approximate 68% decrease in oil price over just 13 weeks.

Although Hornbeck’s announcement is an indicator of things to come for companies that avoided bankruptcy during the 2015-2016 price drop, there is also the potential that companies who restructured during this period could be headed for chapter 22 filings (i.e. a second chapter 11 case). For instance, Fieldwood Energy, who confirmed a chapter 11 plan in April 2018, announced this week that they have retained financial advisors and its ad hoc group of lenders have retained counsel.

In fact, over the five years from 2015-2019, 208 producers filed for bankruptcy, including 94 filings in Texas and 11 filings in Louisiana. While some of these companies were able to restructure their balance sheets and shed certain liabilities, the terms of certain restructurings required the company to retain secured debt at a level that the company could service based upon then available future pricing. It’s safe to say that none of the financial projections relied upon by these companies anticipated the current state of affairs.

Oil companies currently in bankruptcy are also feeling the liquidity crunch.

- Sanchez Energy Corporation filed for bankruptcy on Aug. 11, 2019, and hoped to propose a plan of reorganization that would provide some level of repayment to its lenders. Now, the company is unsure that it will be able to fully repay the loan it received to finance the bankruptcy case and is working to void a chapter 7 conversion. Counsel for the debtor recently reported to Debtwire that the business plan and exit financing have all become irrelevant.

- EP Energy confirmed its plan of reorganization on March 6 but within days entered into a stipulation with its lenders to terminate the plan. The future of the case is currently uncertain.

- Alta Mesa Holdings’ planned bankruptcy asset sale has been pending approval of a $100 million price drop because the potential buyers would be in immediate default of its purchase loan that was premised on oil prices maintaining a certain level.

Law firms are taking note and preparing for what is an expected increase in bankruptcy filings, not only in the oil and gas industry but across the board. For instance, Hogan Lovells announced that it would offer its attorneys in other practice areas the opportunity to receive restructuring cross-training to assist the firm’s existing practice ahead of an anticipated rush of bankruptcy filings in the aftermath of the COVID-19 pandemic. Congress has also taken note when it temporarily increased the debt limit under the recently enacted Small Business Reorganization Act of 2019 from $2,725,625 to $7,500,000, opening the streamlined small business bankruptcy to a wider range of businesses at a much-needed time.

What is certain is that companies will seek bankruptcy protection. Phelps’ experienced team of bankruptcy and business advisors are monitoring the current situation and will continue to provide useful updates. As always, we are available to provide guidance and advice as these issues continue to develop and evolve.