Benefiting From Gulf South Reach, Phelps Dunbar Posts Double-Digit Increases in Revenue, Profits

This article was written and published by Law.com on March 20, 2023.

The New Orleans-founded firm benefited in 2022 from offices across the Southeast, value pricing, and strong demand in core practices.

What You Need to Know

-

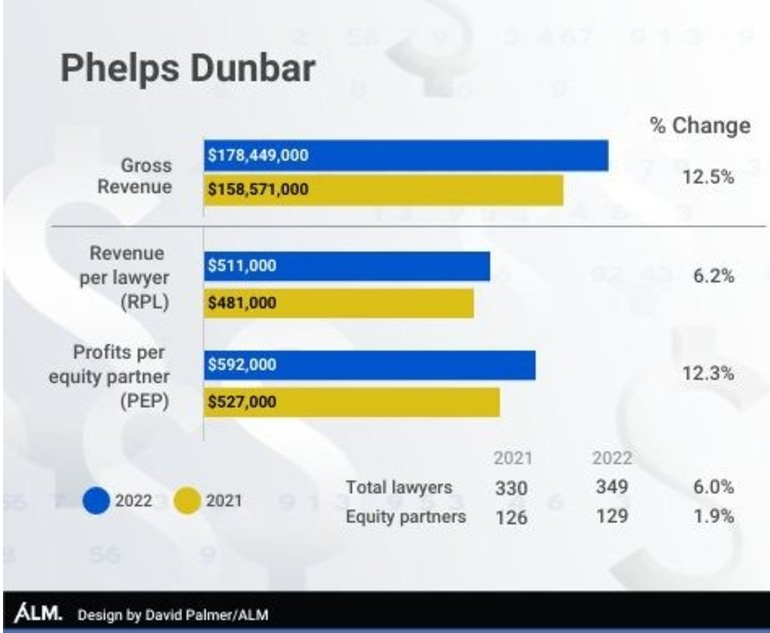

- 2022 was a record year at Phelps Dunbar, with revenue up 12.5% and profits up 12.3% over 2021.

- Higher demand, value pricing and growth helped drive financial results for the Southeast-focused firm.

- The firm plans to continue its upward trajectory.

Driven by growth, value pricing and demand across core practices, Phelps Dunbar posted a 12.5% increase in revenue and a 12.3% improvement in profits per equity partner in 2022, as the Louisiana-founded firm leveraged its Gulf South focus.

Demand increased by about 10% overall, contributing to the increase in revenue, which was also boosted by a 6% increase in lawyer head count. Managing partner Marshall Redmon said “marginally higher” billing rates also contributed to the increase in revenue, but the firm remains a “value proposition” in its markets and for the work it does.

Revenue improved by nearly $20 million to $178.5 million in 2022, up 12.5% when compared with $158.6 million in 2021, while net income was $76.1 million, a 14.5% increase when compared with $66.5 million the year before. Profits per equity partner were $592,000, up 12.3% from $527,000 the year before, as the number of equity partners ticked up 1.9% from 2021.

The New Orleans-founded firm’s total head count was 349 on a full-time equivalent basis, up 6% when compared with 330 in 2021. The firm had 129 equity partners, up 1.9% from 126 the year before.

Despite the rise in lawyers, revenue per lawyer increased to $551,000, up 6.2% from $481,000.

The record 2022 results compare favorably with 2021, when revenue improved by 9.7% when compared with 2020, but net income dropped by 4.6%. With the total lawyer count up by 5.3% in 2021, RPL improved by 4.2%, but PEP dropped by 8.5% as the number of equity partners increased by 4.3%.

Redmon said the strong financials in 2022 come after the firm “did an introspection” five years ago asking “two fundamental and basic questions: who are we and who do we want to be.”

The pressing question was whether the firm needed to shift into something different from a regional firm, he said.

“We concluded for our firm, and our long-term best interests of those clients we serve, that it made the most sense for us to remain focused on a reasonable platform that’s based in the South,” he said.

With that, Redmon said, the firm continues to be competitive for the best talent in its markets, it has strong and deep local knowledge of those markets, and in markets where the firm has a national reach, the firm offers value.

The firm has offices in Louisiana, Alabama, Mississippi, North Carolina, Florida and Texas. It also has an office in London, but Redmon said the firm has no lawyers based there.

The firm implemented a strategy beginning in 2018 to grow more vertically than horizontally, adding strength to strength while staying within the general parameters of the firm’s Southern footprint, he said. Additionally, the firm added heft to its business development and client service side, and invested in technology.

That purposeful strategy is paying off, Redmon said.

“It wasn’t a dramatic sea change. It was an acceleration of strategies that had largely been in place, and a fine-tuning of those,” he said, adding that the firm moved into “more of an aggressive growth mindset.”

In 2022, Redmon said, the firm reaped the benefits of investment in young partners—both laterals and those promoted at the firm. The firm’s equity-only partnership, he said, reflects an “entrepreneurial ownership attitude.”

Demand was up healthily across practices in 2022, he said, with busy areas in real estate, health care, labor and employment, and insurance coverage.

Expenses increased in 2022 compared with 2020 and 2021, he said, because costs that declined during the pandemic ramped back up. Compensation costs are the highest expense burden, he said.

While hoping that lawyers will come into the office three or more days a week, Redmon said the reality is that the vast majority of lawyers are in the office more often than not. The firm has no plans to reduce the size of its offices because people are coming into the office and the firm is growing, he said.

“We are not looking at all at cuts,” Redmon said. “We are very much still on a growth mindset and a search for the right talent.”

The firm has benefited from the 2021 acquisition of Alabama’s Cabaniss, Johnston, Gardner, Dumas & O’Neal, he said.

Among large transactions, the firm represented Entergy Louisiana in a $3.19 billion securitization financing that closed in May, which will help the company recover restoration costs related to multiple hurricanes and winter storms. The firm is also advising CF Industries on a $198.5 million carbon capture project, and the Board of Commissioners of the Port of New Orleans on a $1.8 billion acquisition and development of a terminal facility from the Port of St. Bernard.

The firm is also lead counsel for a primary defendant in the class action wrongful death lawsuit stemming from the collapse of the Champlain Towers in Surfside, Florida.

The firm’s lateral hires in 2022 include white-collar partner Shaun Clarke, who joined the firm in New Orleans from Houston’s Smyser Kaplan & Veselka; Clinton Wolbert, who joined as a partner in Houston from the city’s Martin, Disiere, Jefferson & Wisdom; and Drew Patty, who joined as a partner in Baton Rouge from McGlinchey Stafford.

When budgeting for 2023, Redmon said, leaders were confident the firm is on the path to produce an outcome in 2023 similar to 2022.

“We frankly didn’t see a reason why that wouldn’t happen when you look at our fundamentals and how we are positioned. Set against that was the macroeconomic uncertainty and the global uncertainty,” he said.

When accounting for all, the firm “added a dose of pessimism” with a 2023 forecast that dials down expectations in case of something unexpected occurs out of the firm’s control, he said.

As it turns out so far, the firm has tracked its 2023 projections, he said. However, he said, the firm is eyeing cautiously what might happen with transactional practices, mergers and acquisitions, and technology. Also, he said, some of the firm’s insurance coverage work was related to the pandemic, which will wind down at a point.